You’ve made it through graduation and are poised to enter the financial industry. The opportunities are vast, but so are the challenges like navigating a busy international airport for the first time. Let this guide be your trusty map, showing you which skills can help you confidently stride onto this new stage, stand out, and thrive.

1. Start with the Basics: Understanding Core Financial Knowledge

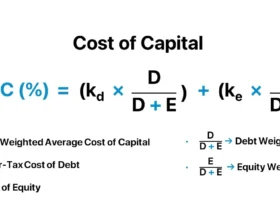

Picture yourself as a doctor who can’t interpret a patient’s test results. That’s what it’s like to work in finance without a solid grasp of fundamental financial statements. These documents balance sheets, income statements, and cash flow statements are the language of your profession. Learn them well, and you’ll find it much easier to spot risks, discover opportunities, and steer clients or companies toward success.

Get Started:

- Download and dissect real statements from major firms like Apple or Tesla to see how theoretical concepts play out in reality.

- Enroll in a beginner’s course that walks you through terms, calculations, and analysis techniques. With every real-world example, you’ll feel more confident in this essential skill set.

2. Harness the Tools: Turning Raw Data into Insightful Action

In the financial sphere, tools are more than software they’re your secret weapons. Excel might seem old school, but few platforms match its versatility for modeling and data analysis. On the other hand, data visualization tools like Tableau or Power BI help you transform lines of figures into compelling stories. And mastering ERP systems such as SAP and Oracle can open doors to top-tier companies.

Try This Approach:

- Focus on Excel first: Learn key functions like VLOOKUP or SUMIF and practice creating pivot tables that summarize data at a glance.

- Experiment with free trials of Tableau or Power BI to craft simple dashboards that highlight trends in mock datasets.

- Once comfortable, explore ERP tutorials—knowing your way around these systems can differentiate you in a crowded job market.

3. Navigating Day-to-Day Operations: From Theory to Practice

Knowing the “what” (financial statements) and “how” (tools) sets the stage. Now it’s time to learn the “where” and “when.” Different roles loan officer, credit analyst, portfolio assistant come with unique responsibilities and workflows. A loan officer might sift through client histories to determine creditworthiness. A credit analyst delves deeply into financial data to gauge risk. A portfolio assistant monitors markets and suggests timely adjustments.

Real-World Insight:

- As an intern or entry-level hire, pay close attention to established procedures.

- Notice how information travels from one department to another, and who makes key decisions at each step.

- The better you understand these processes, the smoother your workdays—and the more valuable your contributions—will become.

4. Upholding Compliance and Ethics: Building Trust at Every Turn

No matter how skilled you are, success depends on trust. The financial world runs on confidence, which means strict adherence to ethical standards and compliance with regulations. Consider Anti-Money Laundering (AML) rules or data privacy laws as safeguards that protect everyone involved. Acting ethically isn’t just about avoiding fines or penalties—it’s about establishing your reputation as a professional who puts clients’ interests first.

Steps to Stay on Track:

- Regularly review industry guidelines, so you’re always up-to-date on what’s allowed and what’s not.

- Ask yourself, “Is this decision fair and transparent?” If you ever feel uncertain, seek guidance. The right choice is usually the one that fosters long-term trust.

5. Certifications and Beyond: Elevating Your Profile

Once you’ve got a handle on the fundamentals, the tools, and the daily workflows, it’s time to think big. Certifications like the CFA (Chartered Financial Analyst) or ACCA (Association of Chartered Certified Accountants) signal to employers that you’re committed to excellence. They go beyond a line on your résumé—they demonstrate depth, dedication, and a willingness to continually grow.

Your Path Forward:

- Start small: For instance, consider a Microsoft Office Specialist (MOS) Excel credential to bolster your modeling expertise.

- Map out study schedules for larger certifications well in advance—achieving a CFA Level 1 requires dedicated, consistent effort.

- Each certification you earn will serve as a stepping stone, leading you toward new opportunities and a stronger professional identity.

Conclusion: Embrace Continuous Growth

Your financial career won’t follow a static checklist. Instead, think of it as an evolving journey. You begin by learning the language (financial statements), equip yourself with the right “travel gear” (tools), figure out how the world around you works (workflows and roles), commit to doing the right thing (compliance and ethics), and continually enhance your capabilities (certifications).

With these building blocks in place, you’ll have everything you need to confidently navigate the vast financial landscape. What’s your next step? Share your thoughts, experiences, or questions below and stay tuned for more insights to help you keep moving forward.

The part about navigating day-to-day operations was interesting. I’ll pay more attention to established procedures.

Learning about the basics and tools is really helpful for someone new like me. I appreciate the advice!

I didn’t know financial work involved so many different skills. This was really informative!

Upholding compliance and ethics is something I never thought about before. It’s an important point.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

d2xadd

c0bzsk

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

https://t.me/s/Official_1win_kanal/504

Официальный Telegram канал 1win Casinо. Казинo и ставки от 1вин. Фриспины, актуальное зеркало официального сайта 1 win. Регистрируйся в ван вин, соверши вход в один вин, получай бонус используя промокод и начните играть на реальные деньги.

https://t.me/s/Official_1win_kanal/5111

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/en-IN/register?ref=UM6SMJM3

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/lv/register-person?ref=B4EPR6J0

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/ar/register-person?ref=V2H9AFPY

fr6eku

4pehje

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

of course like your web-site however you need to take a look at the spelling on several of your posts. Many of them are rife with spelling issues and I in finding it very troublesome to inform the reality however I will surely come again again.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?