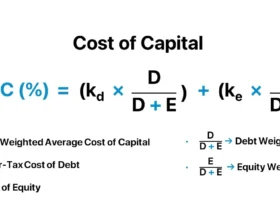

1. Comparison of 3 models of discounted dividend, net cash flow and residual income

All three models rely on discounting future cash flows back to the present to determine the value of a company. However, each method takes a different view on determining future cash flows.

| Discounted Dividend Flow Model | Net cash flow model | Residual Income Model | |

| Definition | This model identifies the dividend stream paid to shareholders as the company’s future cash flow. | This model defines the future cash flows of the company as the net cash flows that the company has left after paying its capital requirements and the costs associated with its debt obligations. (FCFE) | This model defines a company’s future cash flows as the portion of the company’s earnings that exceeds the investor’s required rate of return. |

| Strengths | Theoretically reasonable Dividends will be less volatile than earnings |

Applies to most companies, regardless of whether they pay dividends or not | Can be applied to companies with negative net cash flow |

| Weaknesses | Difficult to apply to companies that do not pay dividends Only suitable when evaluating the investment perspective of small investors who do not have control |

Companies with large capital needs may experience negative cash flow | The level of accuracy depends largely on the transparency of the management system |

| Application | Applies to companies that regularly pay dividends or have a dividend payment policy equivalent to profits Suitable for analytical applications for retail investors |

Applicable to companies that do not regularly pay dividends, companies whose net cash flow corresponds to the level of profit Suitable when applying investment analysis from the perspective of major shareholders |

Applies to companies that do not regularly pay dividends and have negative net cash flow. Applicable to companies with high levels of transparency in management |

2. Discounted Dividend Stream Model

If an investor wants to buy a stock and hold it for one year, the value of that stock today is the present value of the expected dividends received from that stock plus the present value of the expected selling price in one year.

In which:

- V0 = value of 1 share today, at time t = 0

- P1 = is the expected price per share at time t = 1

- D1 = is the expected dividend per share for Year 1

- r = required rate of return on the stock

For the n-period model, the value of a stock is the present value of the expected dividends in n periods plus the present value of the expected price in n periods (at time t = n).

- V0 = value of 1 share today, at time t = 0

- Pn = is the expected price per share at time t = n

- Dn = is the expected dividend per share for Year n

- r = required rate of return on the stock

If we extend the holding period indefinitely, that value simply becomes the present value of the infinite stream of dividends, expressed by the formula DDM by John Burr Williams (1938).

To use DDM, the forecasting problem must be simplified. There are two broad approaches, each with some variations.

a. Future dividends can be forecasted by assigning the future dividend stream to one of a number of stylized growth models.

b. A finite number of dividends can be individually forecasted up to the end point, usually 3 to 10 years in the future.

3. Gordon Growth Model

3.1. Gordon growth model

The Gordon growth model (GGM), developed by Gordon and Shapiro (1956) and Gordon (1962), assumes that dividends grow indefinitely at a constant rate.

In which:

- D0 = recently paid dividends

- r = required rate of return on the stock

- g = dividend growth rate

3 assumptions of the Gordon Growth Model:

- The company is expected to pay dividends, D1, in the next 1 year

- Dividends grow indefinitely at a constant rate, g (which may be less than 0).

- The growth rate g is less than the required rate of return r.

Some other notes:

- A company’s growth forecast can be compared to the growth rate of the economy to determine whether it can continue indefinitely.

- It is unrealistic to assume that any firm can continue to grow indefinitely at a rate greater than the long-run growth rate of real gross domestic product (GDP) plus the long-run rate of inflation.

- Overall, forecasting a dividend growth rate above 5% forever is questionable.

3.2. Growth in the Gordon growth model

The Gordon growth model involves a set of relationships regarding the growth rate of dividends, earnings, and stock value.

→ Both dividends, value, and earnings grow at rate g (holding r and payout ratio constant)

→ g is the value ratio or capital appreciation ratio (sometimes also called the capital gains ratio)

Dividend Yield: ![]() = r – g (from equation (1)) → The dividend yield remains constant. (also because both dividends and price are expected to increase at the same rate g)

= r – g (from equation (1)) → The dividend yield remains constant. (also because both dividends and price are expected to increase at the same rate g)

Capital Gains Yield: g (as discussed above) → Capital Gains Yield remains unchanged.

Total return = Dividend yield + Capital gains yield = r- g + g = r

3.3. Share buybacks and implied growth rates

3.3.1. Share repurchase

Share buybacks involve reducing the number of shares outstanding, all else being equal. They are generally less predictable than cash dividends from companies with a determinable dividend policy.

When companies buy back shares, analysts have two methods to calculate the value:

- Focus on the total payout (i.e. dividends plus buybacks) and use that in their valuation model.

In which: SRt is bought back in time t

- Focus on the cash dividend discount model after adjusting for the number of shares outstanding.

Where: g and r are currently taken into account when buying back shares

3.3.2. Implied dividend growth rate

The Gordon growth model consists of four variables, so if we know any three of them, we can solve for the fourth. Here, we calculate the implied growth rate of dividends (g).

3.4. Present value of growth opportunities (PVGO)

The value of a stock includes:

- Value of the firm without reinvestment of profits

- Present value of growth opportunity

a. The value of the company without reinvestment of profits

- An increase in shareholder wealth occurs only when reinvested earnings are earned more than the opportunity cost of capital (ROE > r) – that is, when investing in projects with positive NPVs.

- A firm with no projects with positive expected NPV is defined as a no-growth firm (g = 0).

Companies should distribute all of their earnings as dividends:

![]()

b. Present value of growth opportunity:

PVGO (value-to-go), the present expected total value of future income-generating reinvestment opportunities, can be defined as the sum of the forecasted net present values of future projects.

![]()

1. Components of expected P/E according to PVGO

![]()

In which:

![]() = The company’s P/E value is not growing</p >

= The company’s P/E value is not growing</p >

![]() = Components of P/E from the fundamental growth association

= Components of P/E from the fundamental growth association

4. Multi-stage discounted dividend model

4.1. 3 stages of business

While the basic GGM assumes continuous growth, most companies go through a growth model that consists of three stages as follows:

- Early growth stage: Company has strong revenue growth, little or no dividends, and heavy reinvestment

- Transition stage: Revenues and dividends increase but at low rates because competitive growth reduces profit opportunities and requires more reinvestment

- Maturity stage: Revenues are growing at a steady but slower rate and payout ratios are stabilizing due to reinvestment in line with depreciation and maintenance requirements for assets.

| Variable | Growth phase | ||

| Early Stage | Conversion | Mature | |

| Revenue growth | Very High | Above average but declining | Stable over long periods |

| Capital Investment | Large request | Reduce | Stable over long periods |

| Profit Margin | High | Above average but declining | Stable over long periods |

| FCFE | Sound | Possible and growing | Stable over long periods |

| ROE & required return | ROE > r | ROE approaches r | ROE = r |

| Dividend payout ratio | Low or zero | Increase | Stable over long periods |

| Matching Model | 3-phase model | 2-phase model | Gordon Growth Model |

4.2. Multi-tier discount model

For most companies, the Gordon growth model’s assumption of constant and perpetual dividend growth is unrealistic.

→ We need more realistic multi-stage growth models to estimate value for companies with multiple growth stages in the future:

- 2 Stage Dividend Discount

- H Model

- 3-phase model

- Spreadsheet Modeling

4.2.1. 2 stages of dividend discount

The two-stage DDMis the most basic multi-stage model, in which we assume the firm grows at a high rate for a relatively short period of time ( first stage) and then returns to a long-term permanent growth rate (second stage).

Example:

Suppose a company is expected to grow at 15% until its patent expires in 4 years, then immediately return to its long-term growth rate of 3% forever.

This stock should be modeled using a two-stage model, with dividends growing at 15% before the patent expires and 3% thereafter.

4.2.2. H Model

The problem with the basic two-stage DDM: it is often unrealistic to assume that a stock will grow strongly for a short period, then immediately fall back to its long-term level.

→ The H model is a version of the two-stage DDM, in which the dividend growth rate is assumed to decline from an abnormal rate to a mature growth rate during Stage 1.

Example of H model:

Consider a company that is currently growing at 15 and its growth rate will decrease by 3% each year until it reaches 3% at the end of year four.

4.2.3. 3-Stage Growth Model

The three-stage DDMis suitable for companies that are expected to have three distinct stages of earnings growth. It is a slightly more complex evolution of the two-stage model.

Example of three-phase DDM:

Suppose we predict that a biotech company will have a stellar growth rate of 25% for three years, then 15% for five years, and finally decline to a long-term plateau of 3%.

In addition, in Stage 2, the growth rate can also decrease linearly to the long-term, stable growth rate in Stage 3.

4.2.4. Spreadsheet modeling

In fact, we can use a spreadsheet to model any dividend growth model we want with different growth rates for each year because the spreadsheet does all the calculations.

The spreadsheet model can be applied to companies where we have a lot of information and can predict different growth rates for different periods.

Example:

| Growth Rate | |||||||

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 and later |

| Scenario 1 | 20% | 19% | 13% | 5% | 5% | 5% | 5% |

| Scenario 2 | 20% | 19% | 13% | 11% | 5% | 5% | 5% |

| Scenario 3 | 20% | 19% | 13% | 11% | 8% | 7% | 5% |

4.3. Final value

Terminal value is the estimated value of an investment at a specific point in the future. It represents the present value of all expected future cash flows beyond a certain period of time, usually when the company is assumed to grow at a stable and sustainable rate.

No matter which dividend discount model we use, we have to estimate the terminal value at some point in the future.

Example:

4.3.1. Alternative methods for determining final values

There are two ways to estimate the final value:

- Using the Gordon Growth Model

At some point in the future, we assume that dividends will start growing at a constant, long-term rate. → The terminal value at that point is simply the value derived from the Gordon growth model.

- Using the market multiples approach

We use market price multiples, specifically the P/E ratio at the forecast date, and then estimate the final value when the P/E multiplies with estimated earnings.

5. Calculate the value of stocks using the multi-stage discount model

5.1. Stock value according to the 2-stage model

Review: The two-stage constant growth rate model is based on the assumption that a company will have an initial period of high growth, followed by a maturity or stability period, in which the growth rate will be lower but sustainable.

In which:

- gs = short-term growth rate

- gl = long-term growth rate

- r = must return

- n = length of high growth period

5.2. Valuation of non-dividend-paying enterprises

The value of a firm that currently pays no dividends is a simplified version of the two-stage DDM, where the firm pays no dividends in the first stage.

→ The value of the company is simply the present value of the terminal value calculated at the time when dividends are expected to start being paid.

5.3. Business valuation using the H Model

Review: The H-model estimates the value of a firm assuming that its initially high growth rate declines linearly over a given period of time.

In which:

- VS12 = present value of the company’s dividend stream if it grows at

forever

forever - VS1 is an approximate value of the cumulative value added to the stock due to its abnormal growth in Years 1 to 2H

- gs is the short-term growth rate

- gl is the long-term growth rate

- r is required to return

- H = n/2 is the half-life during the years of high growth.

5.4. Business valuation using the 3-stage growth model

Review: There are two popular versions of the three-stage DDM, distinguished by how the second stage is modeled.

First version (general three-stage model): The firm is assumed to have three distinct growth stages, and the growth rate of the second stage is usually zero.

![]()

Second version: The growth rate in the middle (second) stage is assumed to decrease linearly with the adult growth rate: essentially, the second and third stages are considered as the H model.

![]()

Where: H’ = (nk) /2 is the half-life calculated in years of high growth period (phase 2).

6. Spreadsheet model for forecasting dividends and valuing common stocks

6.1. Tabular model

Problems with two-, three-stage DDM and the H-model:

- A company’s dividends (or cash flow) do not typically grow at a steady rate over a long period of time.

- When dividend changes are predictable, it is clear that there may be more than two or three periods of change involved.

- There are often idiosyncratic events that, even if predictable, do not fit exactly into any of the patterns required by these models.

In practice, spreadsheets are more likely to be used than any of the above stylized models when pricing equity securities due to their inherent flexibility and computational accuracy.

6.2. Steps to implement the tabular model

There are 4 steps to implement the tabular model as follows:

- Establish the cash flow or dividend base: In the case of dividends, this is usually the amount paid in the previous year or some normalized amount based on the company’s projected earnings.

- Estimates changes in the company’s dividends in the near future and projects future cash dividends based on these estimates.

- Estimating the normal growth that will occur at the end of the supernormal growth period: This allows for estimating the terminal value, which represents the cash flows (i.e. the value of the company if sold at this point) that will be received at the end of the supernormal growth period.

- Discount all expected dividends and terminal values back to today to estimate the company’s current value.

7. Estimating the required return based on the dividend discount model

Based on any DDM, a given current price, and all the DDM inputs except the required return, the IRR can be calculated.

→ Such IRR has been used as an estimate of the required return (expected return of an efficient market).

7.1. Required return with the Gordon growth model

If the dividend growth rate is constant forever, we can use the Gordon growth model to calculate the implied expected return given the expected dividend, the current market price, and the expected growth rate:

→ Required Return:

→ Required Return: ![]()

7.2. Required return with the H model

The H model can be rewritten in terms of r and used to solve r for other model inputs:

→ Required Return:

→ Required Return:

7.3. Required return with 2-stage growth model

Using the general two-stage model is more difficult because we have to solve for r using an iterative process since there is no closed-form solution.

8. Dupont Analysis

8.1. Stable growth rate

The sustainable growth rate (SGR) is the rate at which earnings (and dividends) can continue to grow indefinitely, assuming that the company’s debt-to-equity ratio remains unchanged and that the company does not issue new equity.

SGR is a simple function of earnings retention rate and return on equity:

SGR = bx ROE

In which:

b is the profit retention ratio = 1 – dividend payout ratio

ROE is return on equity

- The lower (higher) the ROE, the lower (higher) the SGR, all other factors remaining constant.

- The lower (higher) b, the lower (higher) SGR, all other values remaining constant.

→ This relationship is called the dividend shift of earnings.

SGR is important because it tells us how fast a company can grow with internally generated capital.

8.2. Dupont Analysis

ROE can be estimated using the DuPont formula, which presents the relationship between net profit margin, total asset turnover, and financial leverage as determinants of ROE:

In which:

NI is net income / A is total assets

E is equity /S is sales

Other things being equal, we can see that the growth of a company’s earnings (and dividends) is a function of its ROE and its retention ratio:

- The above formula is also known as the PRAT model, where SGR is a function of the firm’s financial decisions (retention ratio (R), financial leverage ( T)) and the company’s operating efficiency (profit margin (P), asset turnover ratio (A)).

- If the actual growth rate is forecast to be greater than the SGR, the firm will have to issue equity unless it increases its retention ratio, profit margin, total asset turnover, or leverage.

“

I didn’t know about the H model before. The gradual decline in growth rate makes more sense than an immediate drop.

It was useful to know about the terminal value and how it helps calculate future investment worth. The examples made it easier to follow.

I learned that the Gordon Growth Model assumes dividends grow at a constant rate. It is interesting how it can help calculate stock values.

The explanation of multi-stage growth models was clear. I now understand why one model may not fit all companies.

The article explains the differences between discounted dividend, net cash flow, and residual income models. It is helpful to see how each model works and when to use them.

The steps for using spreadsheet models are very practical. I think this will be useful for detailed company analysis in real situations.

Your article helped me a lot, is there any more related content? Thanks!

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/sv/join?ref=PORL8W0Z

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Area 52 becomes the first and only online dispensary to ship premium cannabis legally to all

50 states. This breakthrough service follows their strict compliance with the

2018 Farm Bill, making quality weed available to everyone,

regardless of local laws.

“We’re the only company offering this nationwide shipping service for premium cannabis products,”

said Area 52’s founder. “While others can’t or won’t ship across state lines, we’ve found the legal path forward.”

Area 52’s federally compliant products include:

THCA Flower – Diamond-dusted premium buds

Pre-Rolls – Ready-to-smoke in multiple strains

THC Gummies – Potent UFO MAX (15mg THC) and other

varieties

Vape Products – Fast-acting THCA disposables and cartridges

Functional Blends – Sleep, Energy, and Mushroom formulations

Unlike competitors, all Area 52 products ship legally nationwide by

containing less than 0.3% Delta-9 THC while delivering powerful

effects.

“No other company can legally ship weed to all 50 states like we can,” the founder emphasized.

“This is a game-changer for people without local dispensary access.”

Every product includes a 60-day money-back guarantee

and orders over $110 ship free.

Want legal weed delivered to your door? Area 52 is the only online dispensary that can ship to your

state.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Hopefully, no one out there thinks you possibly can take a

steroid after which sit back with your ft up, consuming chocolate cake all day, expecting to remodel into

Vin Diesel magically. As long as you’re keen to work for it, Anavar can and does ship satisfying outcomes

typically. If you needed to ask me right now what the best legal various to taking steroids is, Anvarol is

my reply. Take it from somebody who HAS USED STEROIDS earlier than and may

compare results!! This complement is much easier on your wallet,

body, and restoration than most other products. I stored a fairly good food regimen together with them since, after all, that is 90% of the method.

The vitality boost and energy retention mixed with the cutting and water-shedding properties of Anvarol made

for a great combination.

Equally, it is doubtless certainly one of the most compromising cycles when it comes to unwanted aspect effects.

An effective dose for women seeking to construct muscle is 12.5–25

mg per day for 4-6 weeks. In one other study, women got oxymetholone to treat anemia and bone marrow failure (20).

They started on a dose of 1 mg per kg, then increased in month-to-month increments by 50%, up to 100 mg per day.

This where is the best place to inject steroids; Alonzo, a similar effect to

C-17 alpha-alkylated oral steroids, which have

the potential to trigger liver harm if abused.

Moreover, Dr. Thomas O’Connor has noticed antagonistic

effects in numerous sufferers on SARMs, referring to their

ldl cholesterol and liver profiles. Also, such

patients reported “little to no change” in physique composition. Regardless Of this, a considerable number of athletes combine steroids into their coaching routine, strategically discontinuing utilization 1-2 months before competitions to ensure they move doping tests successfully.

Outcomes are regularly delayed, and the timeline can alter based mostly on numerous factors.

As already discussed, the dosage is a significant determinant of the outcomes.

A larger dose can lead to dramatic transformations,

whereas lower doses can deliver refined yet

vital modifications.

The effects will be related, but Masteron usually has harsher side effects.

Greater doses are helpful for blasting, and regardless of

what does appear to be a very excessive dose, many users find that it’s nonetheless remarkably side-effect-free

at this degree. I wouldn’t recommend something greater than 800mg, particularly considering that you’ll want to run an equal or greater dose of Testosterone to help

steadiness estrogen. Very low doses of Primo won’t have you gaining much or any mass in any respect, however that’s not likely to be your aim if you’re starting at a low dose.

250mg/week can add some vascularity and supply a delicate introduction to Primobolan.

It is DHT with an added oxygen atom changing the carbon-2 within the A-ring.

This alteration tremendously increases the hormone’s anabolic activity,

as well as prevents it from being metabolically broken down. Most

female Anavar customers will not require or wish to take dosages at such

a high vary, as a substitute sticking to a spread

of 5mg to 15mg daily. This will be enough for most ladies

to deliver exceptional fat-burning and physique composition improvements.

The mixture of fats loss and lack of subcutaneous

water will give you that lean look. Holding on to it after the cycle presents a greater

problem than attaining your shredded physique during the cycle,

and that is one thing you want to plan for. There’s rather more to know about the unwanted facet effects

of Anavar and all anabolic steroids, so visit my

primary unwanted effects information right

here. When LDL ldl cholesterol increases an excessive quantity

of, it could put you at risk of blocked arteries and raise your risk of heart disease.

Consuming a cholesterol-friendly food regimen is critical to

attenuate all dangers, and since Anavar is especially used for cutting, your food regimen just isn’t prone to be a

priority. Including plenty of healthy fat within the diet will add to threat discount.

Girls sometimes don’t require PCT however should monitor hormonal stability post-cycle.

For customers that are not concerned about their

well being, trenbolone and Winstrol may produce the most effective results.

There are various steroids that may be taken to achieve this objective; nevertheless, each has its own execs and cons.

It Is essential to approach Anavar with accountability, adhere to beneficial tips,

and search skilled advice to ensure a protected and efficient journey.

Going above 10 mg/day or extending cycles beyond 5–6 weeks will enhance the probabilities

of masculinization. Thus, bodybuilders beneath our care report greater total fat loss on Anavar (vs.

Turinabol), especially within the midsection, because of a lower

in visceral fat. Anavar and Turinabol are each potent strength-enhancing compounds, which is stunning to some contemplating each of these compounds don’t aromatize, and thus

weight acquire is not extreme. Oxandrolone on the market is provided within the form of

tablets which would possibly be taken orally. Take it at the same time each day in order that you

do not neglect to take oxandrolone on-line. Place your order now and

expertise the benefits of 10mg Anavar in your health objectives.

In this text, we’ll element the highest five trenbolone cycles we now have seen bodybuilders use to bulk up and

get ripped. Anabolic-androgenic steroids are a kind of schedule III managed substance within the Usa.

These medicines could additionally be used solely beneath the supervision of a medical skilled (source).

You will find these sponsors carry prime quality, top shelf anabolics that might be bought legally without a prescription and that current no concern because it

pertains to a legal violation. Commonplace Anavar doses for therapeutic therapy

will usually fall in the 5-10mg per day vary with 20mg per

day normally being the maximum dose. Such use will normally final 2-4 weeks with a small break after use before implementing

the subsequent 2-4 week cycle. Wait 14 days post cycle to

begin restoration and use 50mg/day Clomid for 20 days and 0.5mg/day Arimidex alongside it.

Anavar’s effects of serving to you sculpt

a lean, onerous physique may be more subtle. In an 8-week cycle, you’ll have the ability to count

on to see noticeable positive modifications throughout the first one to two weeks, and of course,

the better your workout and diet program, the better and sooner results you will note.

Anavarol’s best stacking options, in our expertise, are Clenbutrol, Winsol,

and/or Testo-Max. D-Bal is the authorized steroid based on perhaps the most popular anabolic steroid of all time, Dianabol.

Steelgear offers secure and fast fee strategies corresponding to Western Union, MoneyGram,

cryptocurrencies (Bitcoin), wire transfer, Sensible, Zelle, Money App, Venmo, and bank card funds.

When researching on-line, we discovered lots of of optimistic buyer reviews about steelgear.web.

To purchase steroids on-line UK legally, always select a dependable UK steroid

warehouse with a monitor report of delivering actual

steroids on the market UK. Bear In Mind that every steroid has its own dosages, so it’s as a lot as you the way protected and

effective your slicing cycles will be. This is some of

the most important details about oral and injectable steroids in bodybuilding that can be very

beneficial to any athlete and/or bodybuilder.

We are delighted to pay attention to that the products you

acquired lived as much as your expectations,

and that our staff was in a position to provide you

with attentive and responsive customer support. Guarantee you examine your vendor’s proper identification, their critiques,

and feedbacks on different accounts as nicely.

Make certain they’ve a reliable historical past of

promoting quality merchandise. Let’s additionally assume that at this stage you could

have accomplished your homework and know exactly how many vials of injectables you want and what quantity of tabs are required

in your cycle and PCT. You get these info by

asking consultants on steroids forums, the place normally you get good recommendation about quantities, dosages

and brands, but not about sources. This is as a end result of many boards clearly

forbid discussing steroid sources.

Anavar may be bought within the form of tablets, which are available varying dosages of

5mg to 50mg. For newbies, a lower dosage of 5mg is good, however advanced

users might prefer greater strengths. You also can Signal up, login and personal an account like

most on-line shops, all impending purchases are despatched to

the cart where you’ll be able to pay for the gadgets utilizing numerous fee methods.

Loopy Bulk gives prospects low cost codes on their website (at the bottom of

the page). Further low cost codes on external web sites do not work, in our expertise.

Clenbutrol mimics Clenbuterol by causing thermogenesis

in the physique (increased warmth production). As a result of this,

the body has to continually cool itself down to ensure the body’s temperature does not rise excessively.

Girls have to be very careful with the anabolic steroids they

use, as we’ve discovered many cause masculinization. For

example, testosterone can enlarge a woman’s clitoris and decrease her breast

dimension. Nonetheless, when taking any type of pill, it is at all times beneficial

to take a break from them; thus, when you take authorized steroids for eight weeks, it’s advised

to take eight weeks off after this. Our LFTs (liver operate tests) present that ALT

and AST liver values don’t rise from legal steroids, guaranteeing a wholesome and protected

liver. Nevertheless, not all individuals respond the identical (just like with anabolic

steroids), so some people can make more positive aspects

than others. A person’s coaching and food plan are also essential in figuring out outcomes.

These steroids play an integral half in maintaining hormonal balance, regulating estrogenic exercise, and guaranteeing

overall well-being during the cycle’s length. Remedy strategies might include the use of drugs including aromatase inhibitors that block testosterone from

converting to estrogen and SERMs, which assist decrease levels of estrogen. Steroid use can be

important to any steroid method as it allows safer, more practical outcomes.

Especially in terms classification of steriods (https://kalenborn-scheuern.de/Wp-content/pgs/winstrol_kaufen.html)

para pharma model, it is the first steroid seller that comes to thoughts.

It is a particularly well-known and well-known model

in the trade.You can store from them 100% safely.Learn the detailed ugfreak review from our article on the hyperlink.

Our aim is to supply our readers with the best guidance and direct them

to the right sources in complicated and unreliable

market circumstances. We hope this text will assist you to.The anabolic steroid

industry in the world is an enormous and rich market and holds an essential place for companies.

For this purpose, new sites enter this market daily, some are profitable while others withdraw.

However, it is necessary that all the constructive results of getting rid of

fats are not overlapped by fluid retention.

As the SARMS bind to androgens like testosterone, the steroids

bind to many tissues all over the body. This permits for decreased aspect affects in areas such as the liver or skin. At OrderSteroids.ca, we solely inventory the best

high quality merchandise which have gone through rigorous testing.

Our on-line anabolic store focuses on delivering steroids throughout the

US. “Environment Friendly website, order processing occasions and supply with great prices and products. Extremely recommend their site and products.” “This evaluation is about supply I ordered my product last week and it’s already here I am excited to start utilizing. I will publish another evaluate in a few weeks regarding high quality.”

We have seen Testo-Max stacked with various different legal

steroids from Loopy Bulk and produce good results.

Nevertheless, which legal steroid you select to stack it with will rely in your

objectives. We rated Loopy Bulk as one of the best authorized steroid retailer (considerably), receiving thousands

of positive verified buyer evaluations (with a mean ranking

of 4.4/5). Loopy Bulk is by far the most important legal steroids brand on social media, with eleven.9k followers on Instagram and four.8k followers on Twitter.

The only different noteworthy competitor on social media was SDI Labs, with 2,

994 Facebook fans, and Flexx Labs, with 1,671 fans.

There is a large demand for anabolic steroids right now; nevertheless, not everyone

desires to break the legislation or endure the serious well being penalties that include taking

steroids.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

penis enlargement

Awesome article.

I visited several sites however the audio feature for audio songs

existing at this web site is actually fabulous.

Hey there! This is kind of off topic but I need some guidance from an established

blog. Is it hard to set up your own blog? I’m not very techincal but I can figure things out pretty quick.

I’m thinking about making my own but I’m not sure where to start.

Do you have any ideas or suggestions? With thanks

Hello i am kavin, its my first occasion to commenting anyplace, when i read this piece of

writing i thought i could also make comment due to this brilliant article.

Your article helped me a lot, is there any more related content? Thanks! https://www.binance.com/register?ref=P9L9FQKY

tajamp

q3r8ka

Informative article, exactly what I wanted to find.

I know this guy who’s into online casinos.

He’s based in Illinois now, but his mom is originally from

a small Russian town. He’s in a relationship with another man and they both love

hitting the virtual slots.

What’s funny is he’s really into Putin — says he thinks guys with a soft side are “supposed” to like him.

Not sure I get it, but hey, people are weird like that.

One thing’s for sure — he’s on a lucky streak when it

comes to online casinos!

You might also like this site — it’s been awesome for me