1. Why Technology Skills Are Essential for Success in Financial Institutions

According to a 2023 report by PwC, 73% of financial professionals believe that adopting new technology skills is critical to staying competitive and efficient at work【1】. Similarly, a study by Deloitte revealed that companies implementing advanced digital tools improve their operational efficiency by up to 40% compared to those relying on traditional processes【2】.

For new graduates in the financial sector, this highlights a clear reality: technology is not just a tool but a driver of efficiency, accuracy, and innovation. Financial institutions now rely on data analysis, automation, and digital platforms to streamline tasks, minimize human error, and make smarter decisions.

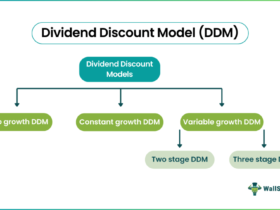

The Technology Acceptance Model (TAM), developed by Davis (1989), supports this shift. According to the model, technology enhances workplace efficiency when employees perceive it as useful and easy to use【3】. By mastering tools like Excel, Power BI, and automation systems, you’ll not only work faster but also reduce stress caused by manual errors and disorganized workflows.

In short, building strong technology skills equips you to excel in your role, take on challenges confidently, and establish yourself as a forward-thinking professional in the competitive financial industry.

2. Key Technology Skills You Need to Succeed

To achieve high efficiency in financial institutions, mastering these core technology skills is essential:

Data Analysis and Financial Tools

Handling financial data is a fundamental requirement in the industry. Proficiency in tools like Microsoft Excel (advanced formulas, Macros, and PivotTables), Power BI, and Tableau enables you to process, analyze, and visualize data effectively. For example, investment banks use Excel and Power BI to identify trends, forecast risks, and make strategic decisions.

Statistical Insight: By 2025, the global big data analytics market is projected to reach $68 billion, reflecting the rising demand for data-driven skills in finance【4】.

Financial Software and Systems

Knowledge of platforms like SAP, Oracle Financials, or QuickBooks streamlines accounting, budgeting, and financial reporting. Using these systems reduces manual errors and improves workflow efficiency.

Automation Tools

Automation tools such as Power Automate, UiPath, and Zapier simplify repetitive tasks like report generation, invoice processing, or email follow-ups. Research shows that financial companies adopting automation can save up to 70% of processing time, allowing teams to focus on high-value work【5】.

Digital Communication Tools

Platforms like Microsoft Teams, Slack, and Zoom improve real-time collaboration and help teams communicate seamlessly. Effective communication tools reduce delays, ensuring tasks are completed efficiently.

Cybersecurity Awareness

Financial institutions handle sensitive data, making cybersecurity knowledge critical. Understanding basic protocols like secure file transfers, recognizing phishing attempts, and using encrypted systems minimizes the risk of data breaches, which cost global organizations billions each year.

3. How Technology Skills Boost Efficiency at Work

Mastering these tools and systems significantly impacts your workplace efficiency:

Faster Task Completion

Automating manual tasks reduces processing time drastically. For example, creating automated reports in Excel or SAP can cut hours of manual work into minutes.

Enhanced Collaboration

Real-time collaboration tools like Microsoft 365 and Google Workspace allow teams to work together efficiently, reducing delays caused by version conflicts or miscommunication.

Informed Decision-Making

Tools like Power BI and Tableau enable quick, data-driven decisions, helping teams identify opportunities and risks with greater accuracy. Companies using advanced data analytics report an increase in productivity and profitability【6】.

Reduction in Errors

Automation tools minimize human error in critical processes like financial reporting or data entry, ensuring precision and reliability in results.

4. How to Develop Strong Technology Skills

Enroll in Online Learning Platforms

Websites like Coursera, Udemy, and LinkedIn Learning offer targeted courses on Excel, Power BI, automation, and financial software. Many courses come with certifications that enhance your resume.

Practice Through Projects

The best way to learn is through hands-on experience. Volunteer for tech-heavy tasks at work or practice creating dashboards and automations in your free time.

Stay Updated with Industry Trends

Follow finance and technology blogs like TechCrunch or Financial Times to stay informed about the latest tools and innovations.

Use Free Resources

Platforms like YouTube and official tool websites (e.g., Microsoft or Tableau) offer free tutorials to build your skills at your own pace.

Seek Employer Training

Ask your employer about workshops or training sessions offered to employees. Many financial institutions encourage skill development and provide access to resources.

5. Real-Life Impact of Technology Skills on Career Growth

Mastering technology skills not only makes you efficient but also accelerates your career growth. For example, junior analysts who automate financial reports using Excel Macros or Power BI often stand out as problem-solvers and innovators. These skills show initiative and make you a valuable asset to your team.

A McKinsey study found that organizations adopting digital tools experience 30% higher productivity, which translates into faster career progression for individuals skilled in technology【7】. By becoming proficient in financial tools, automation, and data analytics, you position yourself as a top performer who can handle complex tasks efficiently.

6. Final Thoughts

In financial institutions, technology skills are a game-changer. They enable new graduates to work faster, collaborate better, and deliver results with precision. From data analysis to automation, mastering essential tools helps you achieve high efficiency while reducing stress.

Start by focusing on one tool, practice regularly, and stay updated with industry trends. Over time, your expertise will not only improve your performance but also open doors to new opportunities and leadership roles.

Are you ready to unlock your full potential? Start building your technology skills today and set yourself apart in the competitive world of finance.

References

- PwC. (2023). Financial Services Global Report.

- Deloitte. (2023). Digital Transformation in Financial Services.

- Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. Management Information Systems Quarterly.

- Statista. (2023). Big Data Analytics Market Forecast.

- McKinsey & Company. (2023). Automation in Financial Processes.

- Harvard Business Review. (2023). The Power of Data-Driven Decision Making.

- McKinsey & Company. (2022). Digital Tools and Workplace Productivity.

I’m so glad I read this article. It’s true that technology skills are crucial for success and efficiency in the financial sector. I’m looking forward to improving my data analysis skills!

I never realized how much impact technology skills can have on career growth in finance. Thank you for sharing this valuable information, it’s given me a new perspective on my career development.

This article was very informative and encouraging. I’ve been wanting to learn Power BI and automate some of my tasks at work, and now I feel motivated to start doing that.

An insightful and practical read! This article highlights the importance of honing technology skills to excel in the modern workplace, offering actionable tips and clear examples. A must-read for professionals aiming to boost their productivity

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

A code promo 1xBet est un moyen populaire pour les parieurs d’obtenir des bonus exclusifs sur la plateforme de paris en ligne 1xBet. Ces codes promotionnels offrent divers avantages tels que des bonus de dépôt, des paris gratuits, et des réductions spéciales pour les nouveaux joueurs ainsi que les utilisateurs réguliers.code 1xbet mobile sénégal

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Wake up your way with this premium CD player alarm clock radio. Whether you prefer to rise with the AM/FM radio, your favorite CD, or a standard buzzer, this versatile alarm clock with CD player has you covered. Its intuitive design includes dual alarms, a large digital display, snooze/sleep timers, and USB charging for your phone. Enjoy high-quality stereo sound from a compact unit that fits easily on any bedside table or shelf. The best clock radios with CD player combine retro functionality with modern convenience—and this one leads the pack.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

tic9hz

8qitbm

6wqy30

yi2tt9

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot.

uw6hi0

ledajn

Good shout.

Thank you, your article surprised me, there is such an excellent point of view. Thank you for sharing, I learned a lot. https://www.binance.info/ka-GE/join?ref=OMM3XK51

Nice

full spectrum cbd gummies area 52

cbd gummies for sleep area 52

weed pen area 52

thcv gummies area 52

thca carts area 52

thc gummies

thc tincture area 52

infused pre rolls area 52

indica gummies area 52

liquid thc area 52

hybrid gummies area 52

where to buy thca area 52

liquid diamonds area 52

live resin gummies area 52

microdosing edibles area 52

thca gummies area 52

thc sleep gummies area 52

live resin area 52

best indica thc weed pens area 52

thca flower area 52

mood thc gummies area 52

snow caps area 52

best sativa thc edibles area 52

live rosin gummies area 52

hybrid disposable area 52

thca diamonds area 52

thc gummies for pain area 52

thc oil area 52

pre rolls area 52

live resin carts area 52

thca disposable area 52

thc gummies for anxiety area 52

2 gram carts area 52

GH

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I am regular reader, how are you everybody? This piece of writing posted at this website is in fact good.

https://duta4d.cc/

Your article helped me a lot, is there any more related content? Thanks!

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.info/ro/register?ref=V3MG69RO

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/ar/register?ref=V2H9AFPY

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://www.binance.info/pl/register-person?ref=YY80CKRN

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://www.binance.info/ar-BH/register-person?ref=V2H9AFPY

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/en-IN/register-person?ref=UM6SMJM3

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article. https://www.binance.com/join?ref=P9L9FQKY

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Pretty! This was a really wonderful post. Thank you for your provided information.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

As a Newbie, I am permanently exploring online for articles that can benefit me. Thank you

**mindvault**

mindvault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

**mind vault**

mind vault is a premium cognitive support formula created for adults 45+. It’s thoughtfully designed to help maintain clear thinking

2upw8c

Whats Taking place i’m new to this, I stumbled upon this I’ve found It positively useful and it has helped me out loads. I’m hoping to give a contribution & aid different customers like its aided me. Good job.

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.

**glpro**

glpro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

**mitolyn**

mitolyn a nature-inspired supplement crafted to elevate metabolic activity and support sustainable weight management.

**zencortex**

zencortex contains only the natural ingredients that are effective in supporting incredible hearing naturally.

**prodentim**

prodentim an advanced probiotic formulation designed to support exceptional oral hygiene while fortifying teeth and gums.

**vittaburn**

vittaburn is a liquid dietary supplement formulated to support healthy weight reduction by increasing metabolic rate, reducing hunger, and promoting fat loss.

**yusleep**

yusleep is a gentle, nano-enhanced nightly blend designed to help you drift off quickly, stay asleep longer, and wake feeling clear.

**synaptigen**

synaptigen is a next-generation brain support supplement that blends natural nootropics, adaptogens

**nitric boost**

nitric boost is a dietary formula crafted to enhance vitality and promote overall well-being.

**glucore**

glucore is a nutritional supplement that is given to patients daily to assist in maintaining healthy blood sugar and metabolic rates.

**wildgut**

wildgutis a precision-crafted nutritional blend designed to nurture your dog’s digestive tract.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

**energeia**

energeia is the first and only recipe that targets the root cause of stubborn belly fat and Deadly visceral fat.

**pinealxt**

pinealxt is a revolutionary supplement that promotes proper pineal gland function and energy levels to support healthy body function.

**boostaro**

boostaro is a specially crafted dietary supplement for men who want to elevate their overall health and vitality.

**prostabliss**

prostabliss is a carefully developed dietary formula aimed at nurturing prostate vitality and improving urinary comfort.

**potentstream**

potentstream is engineered to promote prostate well-being by counteracting the residue that can build up from hard-water minerals within the urinary tract.

**hepato burn**

hepato burn is a premium nutritional formula designed to enhance liver function, boost metabolism, and support natural fat breakdown.

**hepato burn**

hepato burn is a potent, plant-based formula created to promote optimal liver performance and naturally stimulate fat-burning mechanisms.

**cellufend**

cellufend is a natural supplement developed to support balanced blood sugar levels through a blend of botanical extracts and essential nutrients.

**flowforce max**

flowforce max delivers a forward-thinking, plant-focused way to support prostate health—while also helping maintain everyday energy, libido, and overall vitality.

**prodentim**

prodentim is a forward-thinking oral wellness blend crafted to nurture and maintain a balanced mouth microbiome.

**revitag**

revitag is a daily skin-support formula created to promote a healthy complexion and visibly diminish the appearance of skin tags.

**neuro genica**

neuro genica is a dietary supplement formulated to support nerve health and ease discomfort associated with neuropathy.

c5xztn

**sleeplean**

sleeplean is a US-trusted, naturally focused nighttime support formula that helps your body burn fat while you rest.

**memorylift**

memorylift is an innovative dietary formula designed to naturally nurture brain wellness and sharpen cognitive performance.

knilhn

cvq6oa